-

Login

More Login links

Internet Banking

Business Internet Banking

Started an application?

Other services

Help

-

Register

More Register links

Internet Banking

Business Internet Banking

Other Services

- Ways of banking More ways of banking links

Internet banking

Mobile banking

Telephone banking

Branches, ATMs and Post Offices

Useful information

Easy-peasy payments

Just a fingertip away with Apple Pay

Tap, pay, go.

Google Pay is here

- Current accounts More current account links

Our current accounts

Choosing an account

Managing your account

Our bank accounts

Find out more and compare our range of accounts

Your application

Log in to complete your online application and get your online decision

Need Help?

- Current account help

- Help and support home

- Credit cards More credit card links

Benefits of a credit card

Useful information

Need Help?

- Credit card help

- Help and support home

- Savings More savings links

- Loans More loan links

- Mortgages More mortgage links

New mortgage customers

Existing mortgage customers

Our mortgages

Tools and guides

Tools & calculators

Find out how much you could borrow, calculate monthly payments and request an Agreement in Principle

Start or continue an Agreement in PrincipleHow much could I borrow?Estimate mortgage repayments

Need Help?

- Mortgage help

- Help and support home

- Insurance More insurance links

Useful information

Home hub

Our hub has been designed especially for you, with a wide variety of hints and tips to help you keep your home and contents safe.

- Current accounts More current account links

- Personal Banking

- Ways of banking

- Current accounts

- Credit cards

- Savings

- Everyday Instant Access accounts

- Fixed term accounts

- Tax efficient savings

- Transfer Your Existing ISA

- Top-up your Cash ISAs

- Cash ISAs - Frequently Asked Questions

- Cash ISA APS

- Children's savings

- Interest Rates and Fees

- Terms and Conditions

- Financial Services Compensation Scheme

- Limited offers Hub

- Loans

- Mortgages

- Insurance

- Branch Locator

- Landing

- Coronavirus Information

Frequently asked questions

Get the answers you need about Yorkshire Bank Cash ISAs

Have a question about Yorkshire Bank Cash ISAs? Have a look at some of the questions we’re asked most often.

Your questions

If you have a Cash ISA Exclusive, then visit our Questions and Answers here.

- What is a Cash ISA?

- Can I have an ISA?

- How many ISAs can I have?

- Can I invest as much as I want into ISAs?

- If I make a withdrawal from my Cash ISA, can I put the same amount back later?

- How do I close my Cash ISA?

- Do I have to close my account at the end of the tax year?

- How do I transfer my Cash ISA to another product or provider?

- I have a Cash ISA which I opened 3 years ago, and I haven’t subscribed to it during this tax year. How much of the balance can I transfer?

- I have already paid £1,000 into an ISA this tax year. Can I transfer my account somewhere else even though I've used some of this year's ISA allowance?

- How long does the transfer process take?

- When do I receive interest on my Cash ISA?

- When will I receive a statement?

- I opened a Cash ISA Fixed Rate Bond this year with Yorkshire Bank. What will happen to the account when the Bond matures?

- Can I subscribe to my Cash ISA - Fixed Rate Bond every Tax Year?

- I have an existing ISA and would like to talk to someone?

- I have tried to make a subscription to my Yorkshire Bank Cash ISA but have received an error message saying I must complete a reactivation form, what does this mean?

- Can you tell me what happens to the ISA allowance of my spouse/civil partner following their death?

- I have an existing Help to Buy : ISA with Yorkshire Bank. How long can I keep it?

- How much can I pay in to my Help to Buy : ISA?

- Can I withdraw money from my Help to Buy: ISA?

- Can I reopen my Help to Buy: ISA if my property purchase falls through?

- Where can I find more details about Help to Buy: ISAs?

Answers

- What is a Cash ISA?

- ISA stands for Individual Savings Account. With a Cash ISA the customer can earn a tax free interest rate. Tax-free indicates that interest is exempt from UK income tax, providing all ISA conditions are met.

- Can I have an ISA?

-

To open a Cash ISA you must be aged 16 or over, to open a Stocks & Shares ISA you must be aged 18 or over.

You also must be resident in the UK for tax purposes (ask your tax office if you are in any doubt about this), or a Crown employee, such as a diplomat or a member of the armed forces, who is working overseas and paid by the government. The spouse or civil partner of one of these people can also open an ISA.

You cannot hold an ISA jointly with, or on behalf of, anyone else.

- How many ISAs can I have?

-

There are limits on the number of ISA accounts you can subscribe to each tax year. You can put money into one Cash ISA and one Stocks & Shares ISA.

In different tax years, you can choose to save with different managers. There are no limits to the number of different ISAs you can hold over time.

- Can I invest as much as I want into ISAs?

-

Customers have the option to save all or some of their full allowance in cash, subject to the overall annual maximum amount of £20,000. You can pay into one of each type of ISA (Cash ISA and Stocks & Shares ISA) during the tax year, in any combination of amounts, provided you do not exceed the overall limit. For example:

- £7500 to a Cash ISA and £12,500 to a Stocks & Shares ISA

- £20,000 to a Cash ISA and nothing to a Stocks & Shares ISA (or £20,000 to a Stocks & Shares ISA and nothing to a Cash ISA)

- £15,000 to a Stocks & Shares ISA and £5000 to a Cash ISA or vice versa

- If I make a withdrawal from my Cash ISA, can I put the same amount back later?

-

Yes, as long as you don’t exceed the ISA allowance limit for that tax year. The annual tax year limits apply to the amount paid into your account in total that tax year, not the account balance.

On a Flexi Cash ISA any subscriptions you make in the current tax year can be withdrawn and replaced without the replacement money counting towards your annual subscription limit. The replacement money has to be paid back into your Flexi Cash ISA in the same tax year it is withdrawn or you will lose the ability to replace it.

- How do I close my Cash ISA?

-

If you wish to close your account you need to give us written notice. The address to write to is Cash ISA Team, Retail Product Fulfilment, Bering House, Mariner Court, Clydebank Business Park, Clydebank, G81 2NR. If you choose to close your Cash ISA Fixed Rate Bond before maturity, a charge will be payable. The charge is dependent on the number of days to Maturity and is detailed in the Terms and Conditions.

- Do I have to close my account at the end of the tax year?

-

No, you may keep your account open and subscribe in subsequent tax years, subject to the terms and conditions of the products. You can also withdraw as much as you like, subject to the terms and conditions, but you can only subscribe up to the relevant annual ISA allowance limit.

Annually on 6th April you get a new ISA allowance, regardless of the present balance in your account, or subscriptions made during the previous year.

- How do I transfer my Cash ISA to another product or provider?

-

To ensure that you do not lose the tax benefits of your ISA, you must not close or withdraw funds from your account. To transfer funds between ISAs, you must complete a Transfer Authority Form with the provider that you want to transfer the funds to. Your new provider will then contact your existing provider to have the funds transferred for you.

- I have a Cash ISA which I opened 3 years ago, and I haven’t subscribed to it during this tax year. How much of the balance can I transfer?

-

You can transfer all or part of the balance in your Cash ISA account that relates to previous tax year subscriptions (subject to terms and conditions of the products that you are transferring between). If you wish to pay into your Cash ISA in the current tax year and then transfer it, all of your current tax year subscriptions must be transferred in full, not part.

- I have already paid £1000 into an ISA this tax year. Can I transfer my account somewhere else even though I've used some of this year's ISA allowance?

-

Yes, but you must transfer all of the £1,000 of your current tax year subscriptions. If you transfer your current tax year subscriptions to another provider, you will not be able to pay into a Cash ISA with your old provider until the start of the next tax year, unless you transfer it back first.

You can only pay into one Cash ISA in any tax year, however you can transfer the current tax year subscription between providers. You can hold multiple Cash ISA products from previous tax years with different providers.

- How long does the transfer process take?

-

It will take up to 15 working days to complete a Cash ISA transfer and it will take up to 30 working days to complete a Stocks & Shares ISA transfer.

Please view the attached CASH ISA Transfer Timeline documentation (PDF, 354 KB).

More information can be found on the Transfer your existing ISAs page

- When do I receive interest on my Cash ISA?

-

- Flexi Cash ISA and Help to Buy ISA: Interest is paid annually on 31st December.

- Cash ISA Fixed Rate Bond: see table below:

Issue Maturity Date Interest capitalised Issue 60 31st May 2023 Annually (31st May*) and at maturity Issue 61 31st July 2023 Annually (31st July*) and at maturity Issue 64 31st August 2023 Annually (31st August*) and at maturity * or the last working day before this date if the date falls on a non-working day

Further details can be found in the Key Features (PDF, 167 KB) document (terms and conditions of the account)

- When will I receive a statement?

-

For the Flexi Cash ISA and Help to Buy: ISA, where there are transactions on your account we will issue you a statement on the 13th monthly. Alternatively, you can opt for a statement to be issued annually on 31st December.

For the Cash ISA Fixed Rate Bonds we will issue a statement to you annually, in the month following the anniversary of your Cash Account opening.

- I opened a Cash ISA Fixed Rate Bond this year with Yorkshire Bank. What will happen to the account when the Bond matures?

-

On maturity of your Cash ISA Fixed Rate Bond, unless you tell us otherwise, your account will be reinvested into a Flexi Cash ISA. We will write to you explaining the options available to you and the rate payable on the Flexi Cash ISA ahead of maturity.

- Can I subscribe to my Cash ISA - Fixed Rate Bond every Tax Year?

-

No. You may only make one subscription per tax year during the period the Cash ISA Fixed Rate Bond is available. If as part of your one-off subscription, you are utilising your current tax year allowance and you do not subscribe using your full allowance, you will be unable to utilise the remainder of your Cash ISA allowance for that current year.

- I have an existing ISA and would like to talk to someone?

-

If you require assistance with your existing ISA product please call us on 0800 587 5000.

- I have tried to make a subscription to my Yorkshire Bank Cash ISA but have received an error message saying I must complete a reactivation form, what does this mean?

-

If you have not subscribed to your Yorkshire Bank Cash ISA in the previous Tax Year please download and complete a Reactivation Form (PDF, opens in new window). This is a HM Revenue & Customs requirement and if not completed any deposits made may be returned.

- Can you tell me what happens to the ISA allowance of my spouse/civil partner following their death?

-

Upon the death of a spouse or civil partner the surviving party is entitled to an extra ISA allowance equal to the value of the ISA(s) held by the spouse/civil partner (even where they do not actually inherit the ISA). This is referred to as the Additional Permitted Subscription (APS), for more detailed information visit our Obtaining additional ISA allowances following the death of your spouse or civil partner page.

- I have an existing Help to Buy : ISA with Yorkshire Bank. How long can I keep it?

-

You can keep saving into the ISA until 30 November 2029. The deadline for claiming the Help to Buy: ISA bonus from the government is on or before 1 December 2030.

- How much can I pay in to my Help to Buy : ISA?

-

You can pay in up to £1,200 in the calendar month of first deposit, and up to £200 in each calendar month after that until November 2029.

- Can I withdraw money from my Help to Buy: ISA?

-

You can take out money whenever you want. Just remember that making withdrawals means it will take longer to build up your savings, as you can only pay in up to £200 per month. Also, the bonus amount you receive from the government is based on the closing balance by the time you claim.

- Can I reopen my Help to Buy: ISA if my property purchase falls through?

-

Yes, providing you ask us to reopen the account within 12 months of the date you closed it. You’ll need to provide a purchase-failure notice from your solicitor or conveyancer.

- Where can I find more details about Help to Buy: ISAs?

-

The government provides full details of the Help to Buy: ISA rules, including eligibility. You can also download our Help to Buy : ISA terms and conditions.

- Personal Banking

- Ways of banking

- Current accounts

- Credit cards

- Savings

- Everyday Instant Access accounts

- Fixed term accounts

- Tax efficient savings

- Transfer Your Existing ISA

- Top-up your Cash ISAs

- Cash ISAs - Frequently Asked Questions

- Cash ISA APS

- Children's savings

- Interest Rates and Fees

- Terms and Conditions

- Financial Services Compensation Scheme

- Limited offers Hub

- Loans

- Mortgages

- Insurance

- Branch Locator

- Landing

- Coronavirus Information

You are here: Personal Banking > Savings > Tax efficient savings > Cash ISAs - Frequently Asked Questions

- About Yorkshire Bank

- About us

- Virgin Money UK PLC

- Media relations

- Careers

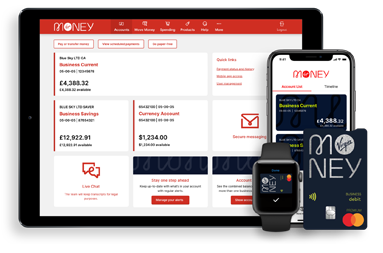

Internet Banking has moved

To log into Internet Banking you now need to use Virgin Money Internet Banking. You'll get the same great service and are able to access all your accounts.

Your log in details will stay the same and you can log in directly from the shiny new Virgin Money website.

Continue to Virgin Money Internet Banking

Go to the Virgin Money website

Be Alert

Never tell anyone a token 3 response code, even someone from the bank. You should only input these codes to our secure Business Internet Banking service when you’re sending and making payments. If anyone calls and asks for a token 3 response code or asks you to authorise a payment on the App for fraud checks, hang up and call us on 0800 085 2914 from another line if possible, remember the Bank will never ask you to disclose your security details.

Continue to Virgin Money Business Internet BankingYou can find impartial information and guidance on money matters on the “MoneyHelper” website.

Yorkshire Bank is covered by the Financial Services Compensation Scheme (FSCS), Find out more.