We're no longer taking new applications for the Instant Savings Account.

Already started an application?

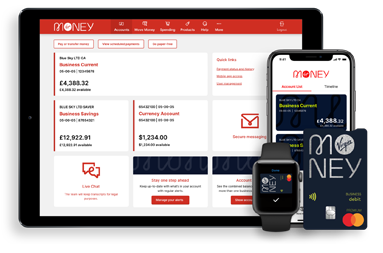

Login to continue with your savings account application

If you have created a username or have your customer number, then we’ll have automatically saved it for you. You can now log in to complete your application or retrieve your decision. If you're not sure what your login details are, or you can't get online for some reason, please give us a call on 0800 587 5000.