-

Login

More Login links

Internet Banking

Business Internet Banking

Started an application?

Other services

Help

-

Register

More Register links

Internet Banking

Business Internet Banking

Other Services

- Our Products More business product links

Bank accounts

- Business current account

- Business choice account

- Switching business accounts

- Compare all business accounts

Savings accounts

Loans and Finance

- All Treasury solutions

Treasury solutions

Help and support

- Online Banking More online banking links

BusinessOnline

- Commercial More commercial business links

Business enquiries

Contact us about a general enquiry.

- Corporate and Structured Finance More corporate business links

Corporate and Structured Finance

SME Cashflow Finance

Unlock your cash flow potential. At Yorkshire Bank we take a flexible approach to business borrowing.

Lending is subject to status and eligibility.

- Our Sector Expertise More sector expertise links

Business Credit Card

A secure way to take care of day-to-day expenses

Want to spend more time thinking about growing your business and less time worrying about your cash flow? The Yorkshire Bank Mastercard® Business Credit Card could help you manage your business finances more effectively.

| Representative example | ||

|---|---|---|

| Rate of interest 16.9% pa (variable) | Total amount of credit £1200 | Representative22.4% APR (variable) |

Benefits

- Up to 59 days' interest free credit on purchases*

- Anti-fraud technology, chip and PIN cards, and Mastercard® Identity Check™ as standard make it a secure way to manage cash flow

- View reports online and help protect your business from fraud

- No annual fee to pay for the first year.**

*Maximum 59 days for purchases if you pay your balance in full and on time. There is no interest free period on cash advances

**Other fees may apply such as an over limit fee, late payment fee, non-sterling transaction fee and cash fee. These are detailed in the business credit card terms and conditions – available from your relationship manager

- Automatically receive special discounts at a range of participating retailers with the Mastercard Business Savings™ scheme. Terms and conditions apply. Full details of the programme and the participants are available at Mastercard Business Savings.

- Use your iPhone, iPad or Apple Watch to make payments from your Business Credit Card in-store or online. Visit our Apple Pay page for more details

A business current account must be held with us throughout the term of the business credit card Agreement.

SmartData

Keep up to date with accounting information and stay in control of your expenses. SmartData, an online accounting system, comes as standard with your Mastercard Business Credit Card. Features include:

- Online access to card spending data for every employee

- Tracking and reporting of detailed card spending, including transaction information, account summaries and other vital information

- Set individualised alerts to help manage card expenditure

- Record keeping for tax time with yearly reports

- Data and reporting delivered directly to your personal computer without complicated desktop software

- Online user guides to assist with every feature.

Important information

SUMMARY BOX - Yorkshire Bank Mastercard Business Card

The information contained in the table below summarises key product features and is not intended to replace any terms and conditions.

| Representative 22.4% APR Variable | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Other Interest Rates | Monthly Rate | Effective Annual Rate | ||||||||||||

| Purchases | 1.313% | 16.9% | ||||||||||||

| Cash Advances | 2.075% | 27.9% | ||||||||||||

| Interest-Free Period | – Maximum 59 days for purchases if you pay your balance in full and on time – There is no interest-free period on cash advances |

|||||||||||||

| Interest Charging Information |

|

|||||||||||||

| Allocation of Payments | If you do not repay the entire balance on your account we will apply the amount you pay to the outstanding balance starting with those items to which the highest rate applies. For further details please refer to your credit card terms and conditions. | |||||||||||||

| Minimum Repayment | Each month you must pay at least the minimum payment set out in your statement by the payment date shown. This will be an amount equal to the greater of:

|

|||||||||||||

| Amount of Credit | Minimum credit limit of £500, maximum credit limit subject to status. | |||||||||||||

| Fees | An annual fee will be charged to your Account for each Card issued, but this fee will not be charged for the first 12 months after a Card is issued – £28 | |||||||||||||

| Charges | Cash advances – Cash Fee 3% (minimum £3.00) Copies of Statements or Vouchers – £5 |

|||||||||||||

| Foreign Usage | Payment Scheme Exchange Rate | Rates can be found at https://www.mastercard.com/global/currencyconversion/index.html | ||||||||||||

| One or more of the following may apply: | Non-Sterling Transaction Fee - 2.95% Cash Fee - 3% (minimum £3.00) |

|||||||||||||

| Default Charges | Late payment or Over limit fees – £12 | |||||||||||||

Information correct as at 18th January 2018

ILLUSTRATIVE EXAMPLE – Yorkshire Bank Mastercard Business Card

| You spend £1,000 on 1st January, make no other transactions and only have one card on the account. The following example highlights the difference between only paying the minimum and a fixed amount each month on your Credit Card | ||

|---|---|---|

| Monthly Payment | Minimum Payment each month | £50 each month |

| Without taking into account any introductory rates, how much interest will you be charged in the first year ? | £135.05 | £112.30 |

| How much interest will you be charged in the second year ? | £131.17 | £50.89 |

| How long would it take to clear the balance ? | 18 years & 5 months | 2 years & 0 months |

Please note, the above example assumes the following:

– Representative 22.4% APR Variable. It excludes introductory rates

– The transaction takes place on 1st January and you make no further transactions

– Your statement is produced on the 1st of each month

– You always make a payment on the due date

– You only have one card on the account.

Useful telephone numbers

– Business Card Helpdesk - 0800 678 3370

– Forgotten your PIN? - 0800 678 3370

– Lost or stolen cards (24 hours) - 0800 678 3370

Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated

Terms and Conditions apply. All facilities are subject to status and applicants must be aged 18 or over.

Business enquiries

Business lending

Our existing customers can apply for lending solutions online. All loans subject to status and eligibility.

Apply now for business lending (opens in a new window)

General enquiries

0800 032 3971

Monday - Friday 8.00am - 6.00pm

Branch locator

Find your nearest branch or private banking centre

Branch locatorNew customers

Start your business current account application process online.

All accounts are subject to status and eligibility.

Compare our business accountsExisting business credit card customers

Forgotten your pin? Need to replace a lost or stolen card? If you’ve got any questions about your account or you’d like to discuss your requirements with our business team, get in touch.

0800 678 3370

Lines open 24 hours

You are here: Business Banking > Our Products > Financial help and loans > Business credit card

- About Yorkshire Bank

- About us

- Virgin Money UK PLC

- Media relations

- Careers

Internet Banking has moved

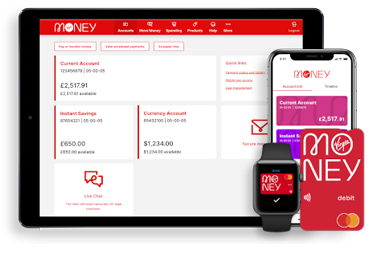

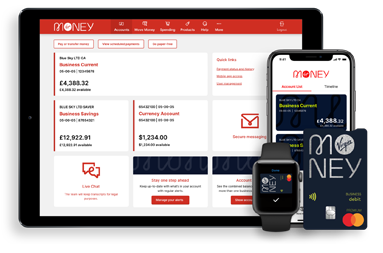

To log into Internet Banking you now need to use Virgin Money Internet Banking. You'll get the same great service and are able to access all your accounts.

Your log in details will stay the same and you can log in directly from the shiny new Virgin Money website.

Continue to Virgin Money Internet Banking

Go to the Virgin Money website

Be Alert

Never tell anyone a token 3 response code, even someone from the bank. You should only input these codes to our secure Business Internet Banking service when you’re sending and making payments. If anyone calls and asks for a token 3 response code or asks you to authorise a payment on the App for fraud checks, hang up and call us on 0800 085 2914 from another line if possible, remember the Bank will never ask you to disclose your security details.

Continue to Virgin Money Business Internet BankingYou can find impartial information and guidance on money matters on the “MoneyHelper” website.

Yorkshire Bank is covered by the Financial Services Compensation Scheme (FSCS), Find out more.