-

Login

More Login links

Internet Banking

Business Internet Banking

Started an application?

Other services

Help

-

Register

More Register links

Internet Banking

Business Internet Banking

Other Services

- Ways of banking More ways of banking links

Internet banking

Mobile banking

Telephone banking

Branches, ATMs and Post Offices

Useful information

Easy-peasy payments

Just a fingertip away with Apple Pay

Tap, pay, go.

Google Pay is here

- Current accounts More current account links

Our current accounts

Choosing an account

Managing your account

Our bank accounts

Find out more and compare our range of accounts

Your application

Log in to complete your online application and get your online decision

Need Help?

- Current account help

- Help and support home

- Credit cards More credit card links

Benefits of a credit card

Useful information

Need Help?

- Credit card help

- Help and support home

- Savings More savings links

- Loans More loan links

- Mortgages More mortgage links

New mortgage customers

Existing mortgage customers

Our mortgages

Tools and guides

Tools & calculators

Find out how much you could borrow, calculate monthly payments and request an Agreement in Principle

Start or continue an Agreement in PrincipleHow much could I borrow?Estimate mortgage repayments

Need Help?

- Mortgage help

- Help and support home

- Insurance More insurance links

Credit card interest rates and charges

Clydesdale Bank, Yorkshire Bank, B and Virgin Money are becoming one bank. Don’t worry if you’re an existing Yorkshire Bank Mastercard customer, the way you use your card won’t change and you’ll still be able to use your card as normal.

If you have any queries about your credit card interest rates and charges, please telephone Customer Services on 0800 678 3320. If you are a Private or Business credit card holder please contact your Relationship Manager.

You are here: Personal Banking > Credit cards > Interest Rates and Charges

- About Yorkshire Bank

- About us

- Virgin Money UK PLC

- Media relations

- Careers

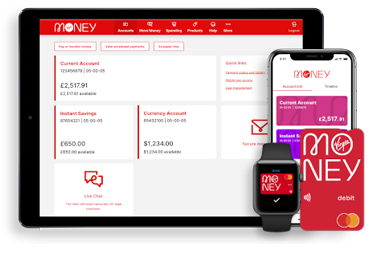

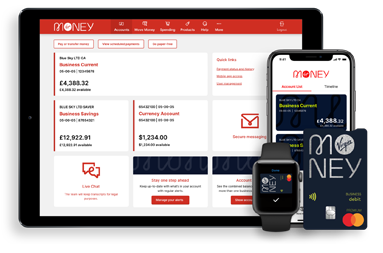

Internet Banking has moved

To log into Internet Banking you now need to use Virgin Money Internet Banking. You'll get the same great service and are able to access all your accounts.

Your log in details will stay the same and you can log in directly from the shiny new Virgin Money website.

Continue to Virgin Money Internet Banking

Go to the Virgin Money website

Be Alert

Never tell anyone a token 3 response code, even someone from the bank. You should only input these codes to our secure Business Internet Banking service when you’re sending and making payments. If anyone calls and asks for a token 3 response code or asks you to authorise a payment on the App for fraud checks, hang up and call us on 0800 085 2914 from another line if possible, remember the Bank will never ask you to disclose your security details.

Continue to Virgin Money Business Internet BankingYou can find impartial information and guidance on money matters on the “MoneyHelper” website.

Yorkshire Bank is covered by the Financial Services Compensation Scheme (FSCS), Find out more. - Current accounts More current account links