-

Login

More Login links

Internet Banking

Business Internet Banking

Started an application?

Other services

Help

-

Register

More Register links

Internet Banking

Business Internet Banking

Other Services

- Ways of banking More ways of banking links

Internet banking

Mobile banking

Telephone banking

Branches, ATMs and Post Offices

Useful information

Easy-peasy payments

Just a fingertip away with Apple Pay

Tap, pay, go.

Google Pay is here

- Current accounts More current account links

Our current accounts

Choosing an account

Managing your account

Our bank accounts

Find out more and compare our range of accounts

Your application

Log in to complete your online application and get your online decision

Need Help?

- Current account help

- Help and support home

- Credit cards More credit card links

Benefits of a credit card

Useful information

Need Help?

- Credit card help

- Help and support home

- Savings More savings links

- Loans More loan links

- Mortgages More mortgage links

New mortgage customers

Existing mortgage customers

Our mortgages

Tools and guides

Tools & calculators

Find out how much you could borrow, calculate monthly payments and request an Agreement in Principle

Start or continue an Agreement in PrincipleHow much could I borrow?Estimate mortgage repayments

Need Help?

- Mortgage help

- Help and support home

- Insurance More insurance links

Credit card Payment Protection Insurance

Annual statement

Your questions

- What is Payment Protection Insurance (PPI)?

- What is a PPI annual statement and why am I getting one?

- Do I have to do something with it?

- My personal details are incorrect, what do I do?

- I don’t want PPI anymore, how can I cancel it?

- I don’t think I’m eligible for this cover, what should I do?

- Who do I speak to if I have a question about my policy?

- My policy summary says that I didn’t receive advice or a recommendation when I bought it. I did, I was advised that I should take out this insurance to cover the payments for my credit card – why is this different?

- Where can I get a copy of the policy wording?

Answers

What is Payment Protection Insurance (PPI)?

PPI is an optional insurance policy that could pay off your Yorkshire Bank credit card balance if you die, have an accident, become ill or are made redundant, subject to eligibility. Terms and conditions apply. See your policy documents for more information.

If you make a successful PPI claim, it will:

Pay your outstanding balance, up to £25,000, if you die.

OR

If you can’t work because of accident, sickness or unemployment, pay 10% of your outstanding balance each month until one of the following:

- You return to work

- The balance on your credit card is cleared

- 12 monthly payments have been made

What is a PPI annual statement and why am I getting one?

PPI statements are a regulatory requirement for customers who have credit card payment protection insurance. They tell you about the type of cover you have and what the cost of this insurance has been over the last 12-months.

They also include the cost of the insurance per £100 of benefit, which lets you compare the cost with other insurance providers.

Do I have to do something with it?

No, it’s for information only, but we recommend you keep it in a safe place in case you need it in the future.

My personal details are incorrect, what do I do?

Call us on 0800 678 3320. Sometimes we can’t update certain pieces of information over the phone. We’ll let you know what to do if this happens.

I don’t want PPI anymore, how can I cancel it?

Just call us on 0800 678 3320. We’ll cancel your cover right away. Please be aware that it can’t be reinstated.

I don’t think I’m eligible for this cover, what should I do?

To be eligible for this cover, at the time you took the plan out you needed to be:

- Aged 18 years or over but under 64

- Work at least 16 hours a week

- Live in the UK

- Be the principal cardholder.

If you don’t think that you’re eligible, we can cancel your cover for you. Call us on 0800 678 3320 to arrange this. Terms and Conditions apply. See your policy document for more information.

Who do I speak to if I have a question about my policy?

Please refer to your policy documents as first reference, if it's relation to whether you can make a claim you should phone the Aviva Claims line on 0800 919 023 (Monday to Friday 9-5pm) or for Policy Queries call 0800 678 3320 (24 hours a day, 7 days a week).

My policy summary says that I didn’t receive advice or a recommendation when I bought it. I did, I was advised that I should take out this insurance to cover the payments for my credit card – why is this different?

If you started your policy in 2008 or before, we would have provided advice. Since 2009 Yorkshire Bank moved to a non-advised sale process. This means that we would have provided you with all the relevant information to make your own decision to take out this insurance. How the policy was sold doesn’t affect the cover it provides in any way.

Where can I get a copy of the policy wording?

PPI for credit cards policy wording (PDF, 304 KB)

If you wish to register a complaint, please contact us:

In writing: Write to Customer Engagement Manager, Clydesdale Bank PLC*, Guildhall, 2nd Floor, 57 Queen Street, Glasgow, G1 3ER

By phone: 0800 055 6655.

* Yorkshire Bank is a trading name of Clydesdale Bank PLC which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Financial Services Register No. 121873

You are here: Personal Banking > Credit cards

- About Yorkshire Bank

- About us

- Virgin Money UK PLC

- Media relations

- Careers

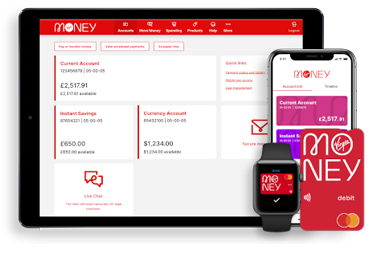

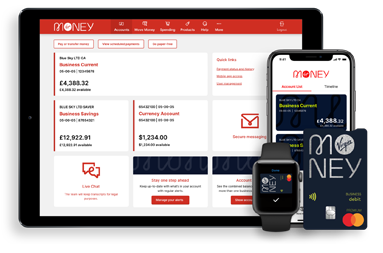

Internet Banking has moved

To log into Internet Banking you now need to use Virgin Money Internet Banking. You'll get the same great service and are able to access all your accounts.

Your log in details will stay the same and you can log in directly from the shiny new Virgin Money website.

Continue to Virgin Money Internet Banking

Go to the Virgin Money website

Be Alert

Never tell anyone a token 3 response code, even someone from the bank. You should only input these codes to our secure Business Internet Banking service when you’re sending and making payments. If anyone calls and asks for a token 3 response code or asks you to authorise a payment on the App for fraud checks, hang up and call us on 0800 085 2914 from another line if possible, remember the Bank will never ask you to disclose your security details.

Continue to Virgin Money Business Internet BankingYou can find impartial information and guidance on money matters on the “MoneyHelper” website.

Yorkshire Bank is covered by the Financial Services Compensation Scheme (FSCS), Find out more. - Current accounts More current account links