-

Login

More Login links

Internet Banking

Business Internet Banking

Started an application?

Other services

Help

-

Register

More Register links

Internet Banking

Business Internet Banking

Other Services

- Our Products More business product links

Bank accounts

- Business current account

- Business choice account

- Switching business accounts

- Compare all business accounts

Savings accounts

Loans and Finance

- All Treasury solutions

Treasury solutions

Help and support

- Online Banking More online banking links

BusinessOnline

- Commercial More commercial business links

Business enquiries

Contact us about a general enquiry.

- Corporate and Structured Finance More corporate business links

Corporate and Structured Finance

SME Cashflow Finance

Unlock your cash flow potential. At Yorkshire Bank we take a flexible approach to business borrowing.

Lending is subject to status and eligibility.

- Our Sector Expertise More sector expertise links

- Business Banking

- Our Products

- Day to Day Banking

- Business accounts

- Payments

- CHAPS

- Bacs

- International payments (SWIFT)

- International Services

- Interest Rates And Charges

- Terms and Conditions

- Email Instruction Frequently asked questions

- Business Savings

- Financial help and loans

- Savings

- Treasury Solutions

- Online Banking

- Commercial

- Corporate and Structured Finance

- Our Sector Expertise

- Completed Deals

- Business News

- Contact us

SEPA Update

What is SEPA

The Single Euro Payments Area (SEPA) is a project developed within the European Union (EU) which seeks to create an integrated market for electronic payments in Euro. It aims to remove the distinction between national and cross-border payments and introduce a common set of payment standards and rules so that payments in Euro can flow quickly and efficiently throughout the EU.

SEPA Regulation

The SEPA Regulation came into force on 30 March 2012 and applies to Member States in the EU including the UK. The purpose of the SEPA Regulation is to drive the migration of existing national payments in Euro to the pan-European SEPA payment schemes to enable businesses and consumers to send and receive cross border payments in Euro as efficiently as domestic payments in Euro are currently made today.

The SEPA Regulation contains deadlines by which existing national Euro payment schemes must be replaced by the SEPA payment schemes:

- 1 February 2014 for Eurozone countries; and,

- 31 October 2016 for non-Eurozone countries.

As the UK does not have the Euro as its national currency, there will be an impact on the way in which businesses send and receive payments in Euro from 31 October 2016.

Impact on business customers

As we already offer single initiated SEPA Credit Transfers, you will not be required to make any technical changes to continue making these types of payment.

However, from 5th July 2016 onwards, we will no longer insist that you provide the BIC when making a single initiated SEPA Credit Transfer and you will only need to provide the IBAN of the account into which you wish to make the payment. This will only apply to SEPA payments i.e. payments sent abroad in other currencies (e.g. Dollars or Sterling) or sent in Euro to a non-SEPA country will require a BIC to enable the payment to reach the correct beneficiary account.

SEPA Credit Transfers are Next Day payments. This means that the beneficiary will receive the funds the day after the payment has been initiated, subject to cut off times and bank holidays. The pricing of SEPA Credit Transfers takes this into account. If you need to send a payment in Euros immediately, you can use our SWIFT service.

For further information on making SEPA payments, please contact your Relationship Manager.

| Glossary of Abbreviations | |

| SEPA | Single Euro Payments Area which includes all European Union Member States as well as Norway, Iceland, Liechtenstein, Switzerland and Monaco |

| IBAN | International Bank Account Number |

| BIC | Business Identifier Code |

- Business Banking

- Our Products

- Day to Day Banking

- Business accounts

- Payments

- CHAPS

- Bacs

- International payments (SWIFT)

- International Services

- Interest Rates And Charges

- Terms and Conditions

- Email Instruction Frequently asked questions

- Business Savings

- Financial help and loans

- Savings

- Treasury Solutions

- Online Banking

- Commercial

- Corporate and Structured Finance

- Our Sector Expertise

- Completed Deals

- Business News

- Contact us

You are here: Business Banking > Our Products > Day to Day Banking > Payments > International payments (SWIFT)

- About Yorkshire Bank

- About us

- Virgin Money UK PLC

- Media relations

- Careers

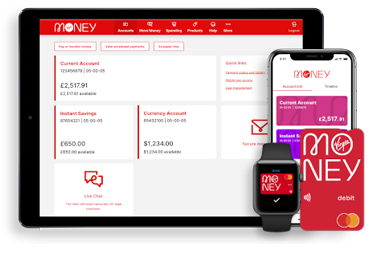

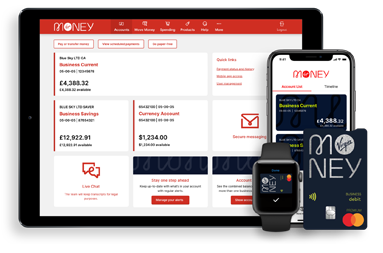

Internet Banking has moved

To log into Internet Banking you now need to use Virgin Money Internet Banking. You'll get the same great service and are able to access all your accounts.

Your log in details will stay the same and you can log in directly from the shiny new Virgin Money website.

Continue to Virgin Money Internet Banking

Go to the Virgin Money website

Be Alert

Never tell anyone a token 3 response code, even someone from the bank. You should only input these codes to our secure Business Internet Banking service when you’re sending and making payments. If anyone calls and asks for a token 3 response code or asks you to authorise a payment on the App for fraud checks, hang up and call us on 0800 085 2914 from another line if possible, remember the Bank will never ask you to disclose your security details.

Continue to Virgin Money Business Internet BankingYou can find impartial information and guidance on money matters on the “MoneyHelper” website.

Yorkshire Bank is covered by the Financial Services Compensation Scheme (FSCS), Find out more.