-

Login

More Login links

Internet Banking

Business Internet Banking

Started an application?

Other services

Help

-

Register

More Register links

Internet Banking

Business Internet Banking

Other Services

- Our Products More business product links

Bank accounts

- Business current account

- Business choice account

- Switching business accounts

- Compare all business accounts

Savings accounts

Loans and Finance

- All Treasury solutions

Treasury solutions

Help and support

- Online Banking More online banking links

BusinessOnline

- Commercial More commercial business links

Business enquiries

Contact us about a general enquiry.

- Corporate and Structured Finance More corporate business links

Corporate and Structured Finance

SME Cashflow Finance

Unlock your cash flow potential. At Yorkshire Bank we take a flexible approach to business borrowing.

Lending is subject to status and eligibility.

- Our Sector Expertise More sector expertise links

A guide to angel investors

< back to all business news articles

19/10/2017

Angel investors are usually successful entrepreneurs, retired business owners or corporate executives in search of investment opportunities with promising businesses. They’re looking for a piece of the action, but they also have investment criteria and expectations.

We’ll help you decide if angel investors are a good option for your business.

What angel investors will expect

In exchange for funding, angel investors typically expect:

- An equity stake in your business – angels will often give a business money in exchange for ownership in the business.

- A return on their investment – angels invest in promising companies with an expectation of making a percentage within a reasonable time frame.

- An exit – angels want to know what the end game is. For example, a public offering or being bought by another business.

Assess your readiness

Your business may need funds to get to the next level, but that doesn’t necessarily mean it’s ready for angel investments. Here’s what you need to know as you consider approaching angels.

The stage of your business

An important criterion for attracting angel investors is the lifecycle stage that your business is in. The best time to approach angels is when you can clearly demonstrate that their investment will help grow your business. If your business is still in its early stages, they’ll want to see ‘proof of concept’ including:

- A sound business plan

- Working prototypes

- Customer contracts

- A record of sales

Angel investors will want the same information for an established business, but they’ll also want to know what your vision is moving forward.

For example, do you plan on using their money to enter a new market, purchase manufacturing equipment that will allow you to increase production, or bring a new product to market? Make sure you can answer the question of how the investment will help your business grow and become more profitable.

Gather information

If your business is at an appropriate stage and you decide that seeking investments from angels is the right approach, the next step involves gathering information. Get out there and:

- Source and access advisers – speak with your bank manager, accountant and work peers to gain as much knowledge on angel investment as you can.

- Network smartly – try not to simply approach the first angel investor that comes along. You’ll want an angel that brings more than just money to the deal. An ideal angel is one who is passionate about what your business is attempting to accomplish, with expertise and a track record of success that you can tap into. Do your research on possible candidates, finding out their past successes, how they operate, and the types and stages of businesses that they prefer to invest in.

Prepare to approach angel investors

Your business may be ready for angel funding, but are you? You will need to be thoroughly prepared with:

- A compelling pitch – why should angels invest in your business? What’s the opportunity and how will it benefit them?

- The details – be ready to discuss your business’s financial projections, its current and potential value, your competitors, any protections you have over your products or services, the proof of concept, and how you want to structure a deal with an investor.

- Paperwork – make sure all of your paperwork is in order, such as your business plan, accounts, IP ownership, and contracts with staff and suppliers.

The challenges of angel investors

Their expectations are often higher than usual. They’re in business to make money, so it’s not uncommon for them to expect a rate of return up to 10 times their investment within the first 5 years. This means you and your business will be under considerable pressure to deliver.

You’ll also need to keep in mind:

- If you include equity as part of the deal, you’re essentially giving away part of your future profit. When you’re negotiating a deal, make sure the amount the investor is asking for won’t compromise your own ability to make a profit.

- Loss of control. Angel investors aren’t going to part with a significant amount of money without having a say in how it’s used. They’ll probably want some decision-making power, so expecting them to take a completely hands-off approach is unrealistic.

It comes down to how much control you’re willing to hand over, and if you think you can realistically live up to the promises you’re making about their investment. If either of these terms is a worry for you, angel investors are probably not a great option.

Summary

Angel investors, while looking for a great return and some say in the business, are more likely to take risks. You may be having trouble qualifying for a small business loan as your growth plans seem risky to some lenders, but sometimes angel investors are willing to go where banks aren’t. “High risk, high reward” is part of their motto, so it comes down to convincing them that while your growth plans might be on the chancy side, you can still present a solid case demonstrating how those plans will succeed.

POSTED IN: Loans and Borrowing,2017,Startup,Raising Funds

SHARE

Related Articles

You are here: Business Banking > Business News > Articles

- About Yorkshire Bank

- About us

- Virgin Money UK PLC

- Media relations

- Careers

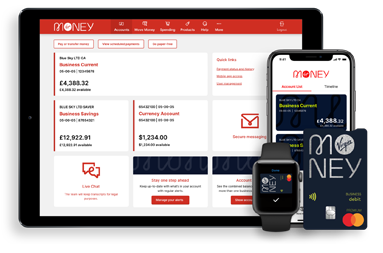

Internet Banking has moved

To log into Internet Banking you now need to use Virgin Money Internet Banking. You'll get the same great service and are able to access all your accounts.

Your log in details will stay the same and you can log in directly from the shiny new Virgin Money website.

Continue to Virgin Money Internet Banking

Go to the Virgin Money website

Be Alert

Never tell anyone a token 3 response code, even someone from the bank. You should only input these codes to our secure Business Internet Banking service when you’re sending and making payments. If anyone calls and asks for a token 3 response code or asks you to authorise a payment on the App for fraud checks, hang up and call us on 0800 085 2914 from another line if possible, remember the Bank will never ask you to disclose your security details.

Continue to Virgin Money Business Internet BankingYou can find impartial information and guidance on money matters on the “MoneyHelper” website.

Yorkshire Bank is covered by the Financial Services Compensation Scheme (FSCS), Find out more.